By Balaji Viswanathan,

Only a living being can get sick or die. Stones don’t die. In the same way, only a market economy can have a market crisis. In that sense, the “free” market is the cause of the crisis. If US had been a Liberia or North Korea, 2008 financial crisis would have never happened.

Like any living thing, markets have ups & downs. They are susceptible to emotions. They swing between euphoria and despair. Since the time of Keynes (1930s) Governments have desperately tried to smooth out these cycles of boom & bust. But, markets have a mind of their own.

“We need more regulations” is an empty and oversimplistic phrase. It is often used by media pundits who don’t understand the markets. More regulations of what kind? Many of the regulations have worsened the crisis and in some other cases relaxation of regulations caused the crisis. For instance, the community development act of 1992 forced the banks to lend more to risky, poor individuals. That is an example of a regulation that worsened the system. Repeal of the Glass-Steagall act enabled the regular banks to “play Vegas”. That is an example of a lack of regulation worsening the system.

You need to look at both, although the fundamental factors involve neither.

Fundamental Causes

1. Overconfidence in math models: In the years running up to the crisis many financial institutions became too reliant math models built out of insufficient data and used that as a substitute for conventional judgment. 15 years of bond market stability lulled them into thinking that the market risk is a thing of the past. Hubris lead to collapse, like in all other human endeavors.

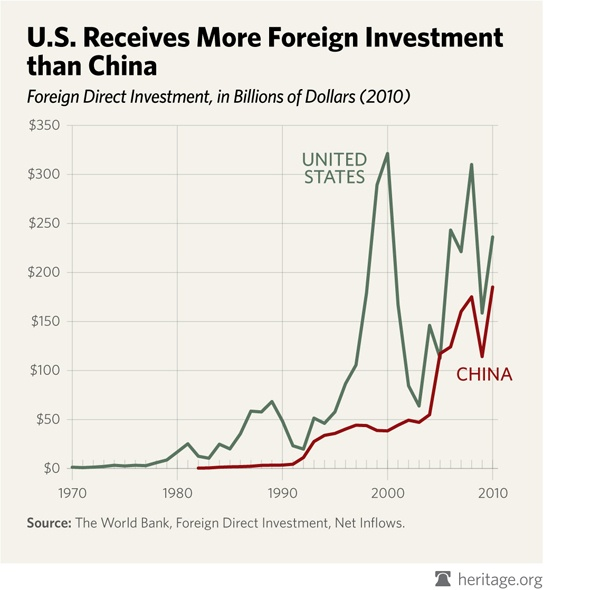

2. Excess capital in the system: US was flooded with cash from global investors since early 1990s. China, Japan, West Asia and other regions brought a lot of dollars the US bond markets, from their exports. This increased availability of capita reduced the returns in a lot of investments, forcing the investors to choose riskier & unproven investment options. Real estate received a lot of attention from the investors, as the bank interest rates & bond rates swung to rock bottom.

3. Herd behavior & communication explosion: The availability of new media since late 1990s increased the magnitude of herd behavior that was always present in humans. People shared stuff about how smart their home investment in 2001 turned out to be. If you didn’t borrow on your home equity, you were considered dumb. Peer pressure got really strong, as people could instantly share photos of their trophy homes. In 2008, this thing worked completely opposite. The trend became on how to walk away from your home mortgages.

Secondary Factors

These fundamental factors now impacted a lot of other secondary factors:

1. Overconfidence in math and herd behavior forced the rating agencies to understate the risk in many investments. No one wanted to look stupid and loose business by playing the tune of caution.

2. Excess capital in the system enabled the US government backed mortgage providers – Freddie Mac and Fannie Mae to expand their home loans.

3. Overconfidence, excess capital and herd behavior led a lot of otherwise conservative US banks & insurance companies to play speculative games in the bond market.

4. The reduced returns in the bonds, forced insurers and pension funds to look beyond their traditional investments. Companies like AIG were tempted to look into unknown territories – such as insuring the bond defaults of big companies.

5. The communication explosion led even the most novice of the investors get access to highly complex mortgages. HELOCs, ARMs and Alt-A loans became available to even the poor and illiterate.